Every spring many highly skilled people in companies across Europe settle in behind their desk and start amassing dozens and dozens of spreadsheets. They start looking at their numbers; adding, subtracting, putting all of the spreadsheet formulas they know to the test, all to achieve the best possible results. All of them racing to the finish line, in a chaotic symphony. Colleagues get involved, even though they might not fully understand what they are getting themselves involved in, all they know is that it is important. It is one of the most important processes conducted in corporate Europe today. In fact, it is perhaps the one process that affects each and every one of us. Europeans or not. It is EU ETS reporting.

EU ETS Overview

In the European Union and European Economic Community, the EU Emissions Trading System enables the Union to cap the amount of emissions coming out of the EU and EEC members. It is the worlds´ biggest scheme for trading greenhouse emissions allowances. A total of over 11,000 Industrial plants, airline operators, power stations and Oil & Gas offshore/onshore installations are reported into the EU ETS by the 31 countries that participate. This constitutes around 45% of Europe’s total greenhouse emissions.

The system is based on allowances, where one allowance or credit consists of a set amount of a greenhouse gas. For instance with CO2: 1 allowance = 1 metric ton of CO2.

As there is a cap of the total amount of emissions allowed, the companies that participate start trading and purchasing allowances to ensure that their emissions are accounted for. If not, they might be subjected to heavy fines.

The cap of EU ETS is reduced over time so total emissions fall.

EU ETS covers Carbon Dioxide(CO2), Nitrous Oxide(N2O) and Perfluorocarbons (PFCs)

EU ETS and Brexit

With a looming Brexit many companies try to understand how that will impact EU ETS in the UK. Although no firm choices have been made, there are some signals to what might be Great Britains next steps. It seems that a hard Brexit might make Britain move over to an Emissions Tax scheme rather than a trade scheme. With a soft Brexit there might be more of an interest to look at a UK ETS scheme which would connect to the EU ETS. Regardless what is decided there is still a need to report and measure the emissions for the UK companies who have greenhouse emissions. The end of October will provide a lot more insight.

There is no doubt that EU ETS is an important measure to ensure a Europe where emissions start dropping rather than increasing. For many companies the process is tough, not only do the staff who report have to have knowledge related to the rules and regulations, but they also need to gather and calculate all the various emissions streams. Then they need to provide qualified and Quality Approved numbers to report to the EU ETS.

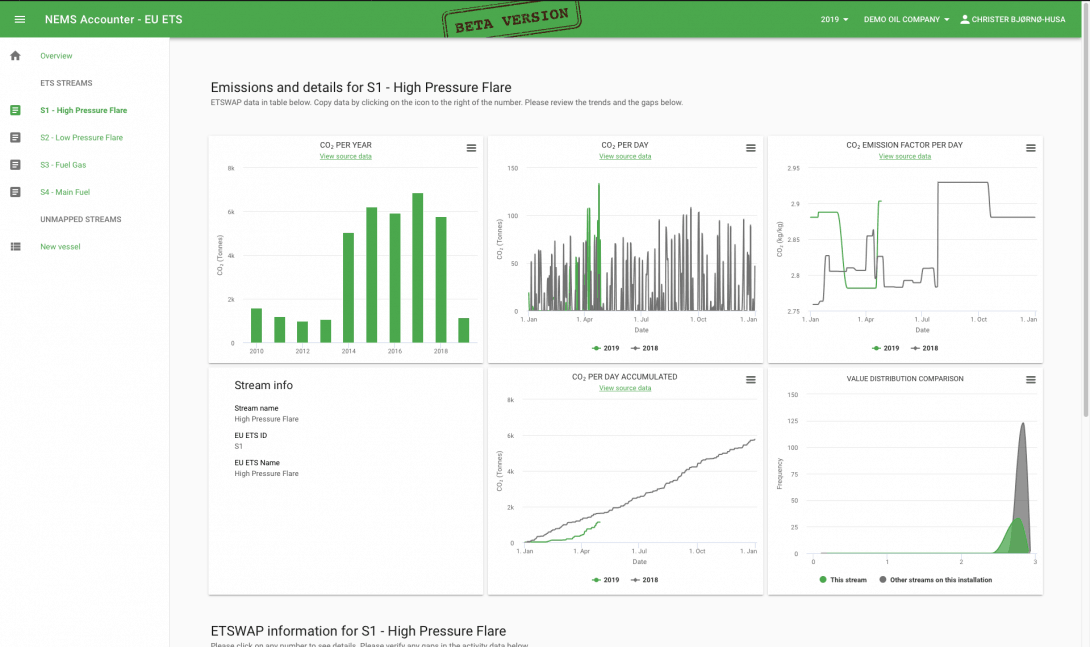

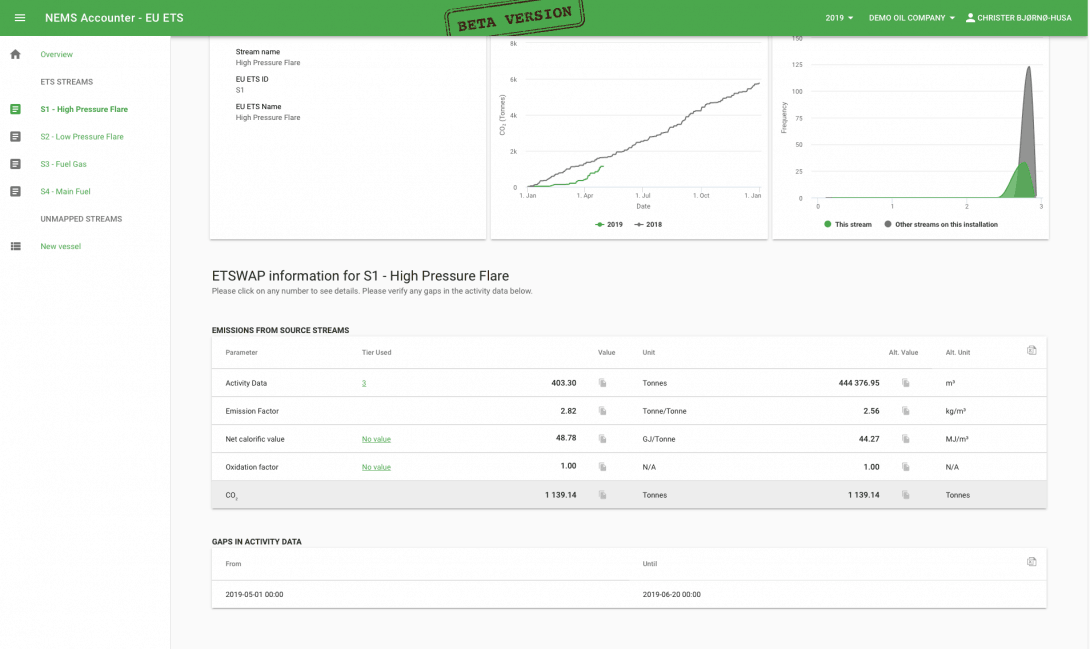

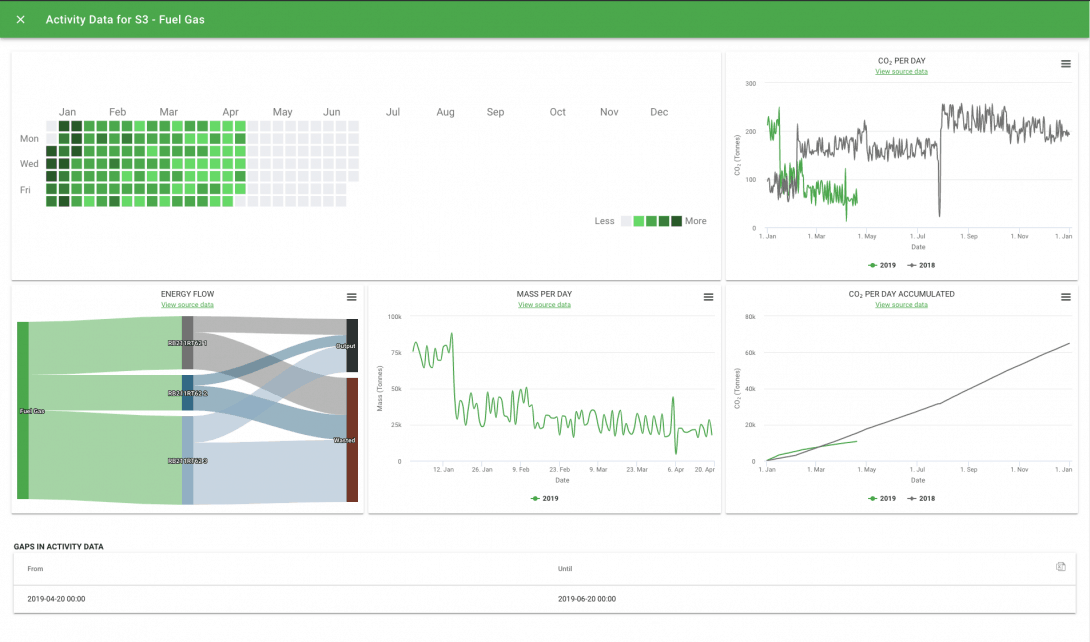

Our NEMS Environmental Suite enables Oil & Gas companies to get better control of their EU ETS process. It helps gather the data automatically from the various streams directly from the production systems. NEMS calculates your emissions and provide instant insights into daily operations and provides a simple place to capture all the necessary numbers that you need to enter into your EU ETS report.

For more information about EU ETS check out:

https://ec.europa.eu/clima/policies/ets_en

To learn how our Environmental Suite and NEMS Accounter can help you get better control of your EU ETS process Get in Touch today.